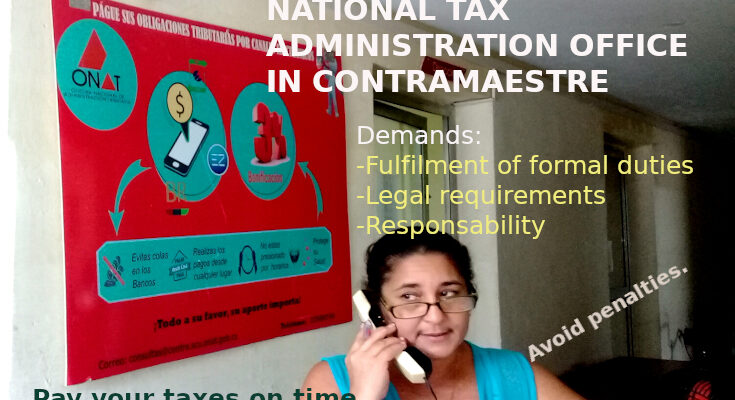

Several actions are being deployed by the Contramaestre Tax Administration Office with the purpose of applying the requirements legally disposed to those who fail to comply with the formal duties and obligations contracted by the taxpayers in the presence of each fiscal year.

Taking into account that the voluntary term for the presentation and payment of the tax return has concluded, the ONAT of this territory proceeds in the upcoming days to act with all those who did not comply with the obligation to present and pay the tax return in the established period, a process that took place between January 8 and April 30, 2024.

As duly informed by the ONAT, for this campaign, the filing of the tax return was extensive and mandatory for all taxpayers: whether or not they had to pay their contribution based on the income obtained in the previous year.

In spite of the above and in accordance with the requirements set forth in Law 164, Budget Law 2024, and without going into figures, individuals in this municipality who work in the non-state sector failed to comply with the aforementioned campaign, including the agricultural and livestock sector.

Among the penalties established in the legislation in force and which are the competence of the Tax Administration for non-compliers are the following: Fines of fixed and percentage amount, Seizure of bank accounts, Migratory regulations and Request for temporary and definitive closing of establishments.

In addition to these penalties, the taxpayer is required to file the tax return under the terms and conditions established. The ONAT reminds that complying with tax obligations within the established term, constitutes a responsibility of the taxpayers and also a social duty since the taxes they pay contribute to the State budget to assume the social expenses committed for the year in the Budget Law.